What Do Hawaiians Invest Their Money And Time In

If taxpayers wanted to know how the millions of dollars the Hawaii Employees' Retirement System collects are being invested and who's doing the investing, a visit last July to the glitzy Ritz-Carlton in Honolulu would have supplied some answers.

Representatives of 50 firms providing consulting, investment management and other services to the ERS crowded into the hotel's ballroom for the pension fund's annual show-and-tell — a three-day meeting where more than 80 pension professionals explained to pension trustees what they were doing with all that money.

Billed as an "investment summit," the sessions gave these outside experts the chance to discuss the ERS investment portfolio, how it could be enhanced and the opportunity to offer their opinions on what trustees might expect in the future. It was also a chance for Wall Street to shake the money tree for additional business.

Wes Michada, executive director of the Employees' Retirement System, is seen here in ERS' Honolulu office, May 23, 2014.

PF Bentley/Civil Beat

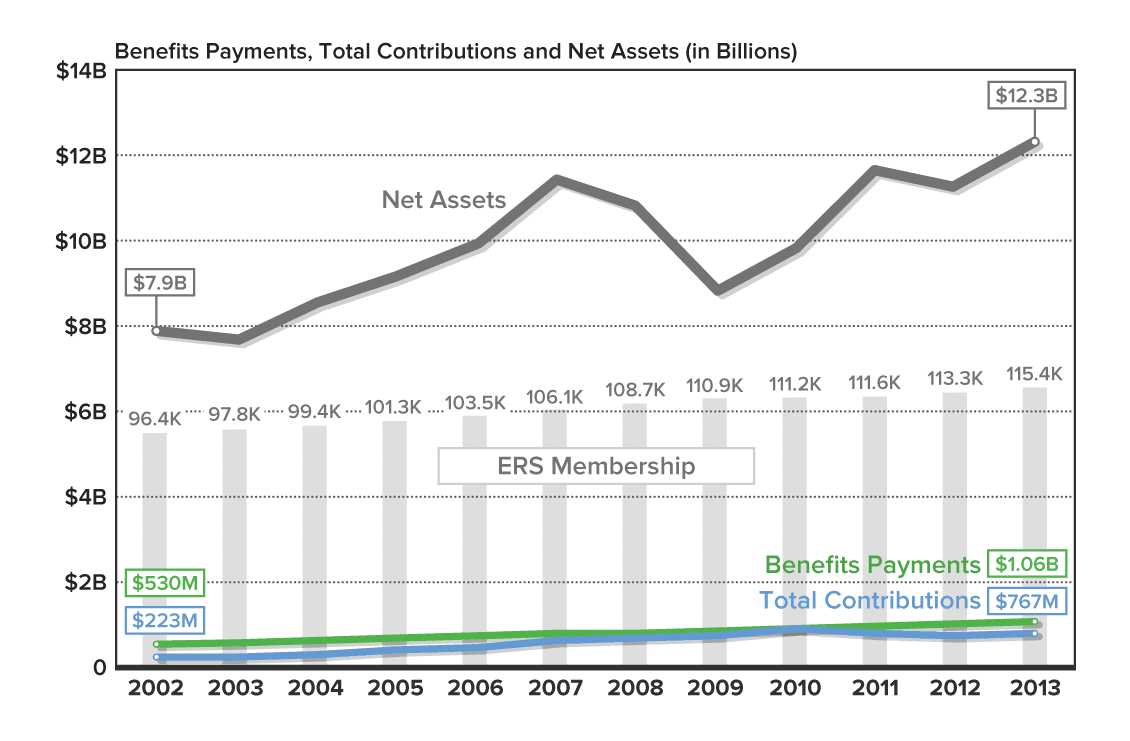

Like hundreds of other public employee pension funds in the United States, the ERS has one primary purpose: providing monthly payments to retired public employees and their families by collecting money from taxpayers and working employees' paychecks that in turn is invested with the expectation of earning even more money to increase existing assets and guarantee a continuing stream of pension payments.

The process is a financial balancing act designed to obtain the biggest payoff for the billions of dollars invested — where the performers include consulting firms offering advice on what investments should be made and who should make them and other consultants who analyze how those investments perform. Along the way there is a supporting cast of investment banks, hedge funds, private equity firms and stockbrokers who actually spend the money.

These services aren't cheap and illustrate why public retirement funds are lucrative feeding grounds for Wall Street. In 2011 — the most recent information available — the ERS paid $107.6 million in investment expenses. This included $40.2 million in fees paid for managing the various investments and more than $4 million in commissions to stockbrokers. The pension fund also reported $66.8 million in expenses related to its real estate holdings.

In 2011 the ERS had 35 different firms managing portions of its investment portfolio — including well-known financial institutions such as Bank of America and JP MorganChase and lesser-known firms like Dallas-based Barrow, Hanley, Mewhinney & Strauss and Oechsle International Advisors of Boston.

By December 2013 the ERS had 40 asset managers with two firms — JP Morgan and Mellon — handling $3.8 billion, or about 28 percent of its total portfolio.

A few managers, like JP Morgan, collect fees with both hands; they are paid for managing portions of the ERS portfolio and receive brokerage commissions for buying and selling stock in the investment portfolio. In 2011 the ERS paid 299 firms $4.1 million in commissions with the top 22 firms receiving more than 80 percent of those fees.

Colbert Matsumoto, an ERS trustee, said all retirement system funds are professionally managed by firms that have been screened and are subject to ERS investment policies.

"Their performance is regularly monitored and evaluated," he said. "We've terminated literally dozens of managers over the years for poor performance. At any given point in time, the overwhelming majority of managers are meeting our expectations. But every once in a while we get managers that will falter."

Besides money managers, Matsumoto said the ERS also hires investment consultants to "help us manage the managers" by monitoring and evaluating performance and making recommendations.

Behind Closed Doors

ERS internal operations are largely shrouded in mystery. Although it publishes a 213-page investment policy and procedures manual, its administrative regulations and minutes of its meetings, many decisions by ERS trustees — such as selection of investment and how much they will be paid — are made behind closed doors in executive sessions that punctuate their monthly meetings.

Although ERS investment procedures require at least 30 periodic reports detailing specific investments and their individual performance, these are read and discussed out of public view by the pension fund's staff and eight trustees.

"We do go into executive session to deal with various investment-related issues which tend to require a level of confidentiality just because of the nature of the topics we sometimes have to cover," Matsumoto said. "But other than that the meetings are pretty much wide open."

During the 35 board meetings held in 2012 and 2013, trustees jumped in and out of secret sessions 54 times.

In 2013 the ERS had 63 percent of its $13.5 billion in assets invested in the stock market — $5.2 billion in the stock of domestic companies and $3.4 billion in foreign stocks.

While many of these closed-door huddles dealt with specific subjects — such as the troubled Royal Kaanapali Golf Course investment or reviewing individual portfolios and deciding what investments to keep or dump — other secret sessions were called pursuant to a broadly written state law allowing trustees "to consult with the Board's attorneys on questions and issues pertaining to the Board's powers, duties, privileges, immunities and liabilities" with hardly a hint of what was discussed.

Unlike California and some other states, Hawaii has no requirement that trustees publicly announce or vote in open meetings on actions taken in executive sessions. Taxpayers and public officials seeking ERS information must rely on what pension fund officials tell them in carefully orchestrated presentations, press releases or outdated financial information.

Wes Machida, ERS executive director, said privacy concerns are mainly what dictate so much discussion behind closed doors. But he said a majority of the decisions are made in public.

"If the board makes a decision in executive session, it will normally make it in regular session too," he said. "What may be absent is the internal private discussions that are occurring that lead up to that decision."

Strategy Is Key

Although the ERS may be tardy with financial information, it is on time with monthly pension checks to its thousands of retirees. So long as its investments perform and state and local governments kick in with their full share of annual contributions, these payments should never be late.

While taxpayers are the ultimate hedge against insolvency, the ERS expects its investment strategy will reduce the amount state and local governments must contribute every year, making investment performance of paramount concern and the reason trustees rely on expensive outside advice. Where the ERS puts its money is often more important than how much money it bets on particular investments.

A critical factor in ERS investment strategy is asset allocation, the composition of its portfolio. What it contains — and how much is invested in stocks, bonds, real estate, venture capital or hedge funds — must be continually monitored and reviewed. It also needs periodic adjustments as economic conditions fluctuate — a process called "rebalancing," where the amount of money put in specific investments is changed.

The ERS invests for the long haul and its portfolio strategy reflects this by establishing allocation "targets" — the percentages and types of investments it wants to hold. In making these decisions the trick is being able to accurately predict the future direction of the economy and financial markets.

"We're not out of the woods yet. … There are hundreds of thousands of people counting on us to pay them what's due." — Wes Machida

At the end of 2013, the mid-point of its 2014 fiscal year, the ERS had 63 percent of its $13.5 billion in assets invested in the stock market — $5.2 billion in the stock of domestic companies and $3.4 billion in foreign stocks. Another $2.3 billion was invested in bonds and the remainder spread among real estate, private equity and other investments.

Some allocations have missed their target. During the last quarter of 2013 the ERS portfolio contained more domestic stock than targeted, but less foreign stock and fixed income (bond) investments than originally earmarked.

With U.S. stock markets on a tear the value of ERS stock holdings increased by $554 million between September and December. Because the current ERS financial report is nearly a year overdue, it's impossible to determine how much additional income the pension fund received in stock dividends last year. In 2011, the ERS reported receiving $102.8 million in dividends.

Wall Street winds are fickle, and what goes up can just as easily come crashing down. The market meltdown of 2008-2009 resulted in a $2.4 billion loss, something the ERS is still trying to recoup. This far exceeded the previous $506 million loss recorded in 2002 when the high-tech bubble burst.

But as the economy has slowly recovered, so have ERS fortunes. In 2011 the pension fund reported a net income of $2 billion from investments, followed by a small $59 million loss in 2012. In 2013 the ERS had net investment income of $1.4 billion.

"We still have more to be done with respect to our funding status," Machida said. "We're not out of the woods yet. All it would take would be another one or two significant downturns in the market before we would be in a dire situation. Wouldn't want that to happen. There are hundreds of thousands of people counting on us to pay them what's due."

Beyond what it pays for investment advice and management, the ERS has its own administrative expenses — paid from investment income — that last year totaled $12.3 million, primarily for salaries and benefits. In 2011, the most recent breakdown available, the ERS reported paying $4.1 million in salaries and $1.5 million in benefits. Professional services cost another $2.7 million.

Expectations Fall Short

ERS performance is measured against an assumed rate of return currently set at 7.75 percent. This means the ERS expects that every year its investments will earn at least that amount.

For years, this rate had been set by law at 8 percent. However, in 2011 state lawmakers reduced that to 7.75 percent and gave the ERS trustees the authority to make future adjustments.

There were years in Hawaii when the investment returns far exceeded 8 percent, but the Legislature took the excess and dumped it into the general fund to use for other programs.

The public-worker unions and some state lawmakers are still sour about this past practice.

Rep. Karl Rhoads sits in the House chambers during the 2014 legislative session.

PF Bentley/Civil Beat

State Rep. Karl Rhoads, who came into office in 2006 after this had stopped, said taking the excess helped dig Hawaii into a deeper hole in terms of its unfunded liability. He has tried, so far unsuccessfully, to pass bills that would return these millions of dollars back to the pension system as originally intended.

Whether rates of return in excess of 7 percent are realistic is the subject of debate among retirement administrators across the country.

A 2013 survey of 77 public funds, conducted by Fitch Ratings, a major municipal rating agency, found that 42 of the funds — including Hawaii's — had reduced their rate of return assumptions between 2008 and 2012 while 33 funds made no change and two funds in South Carolina actually raised their rate projections. Many funds resist reducing rates of return because reductions lower investment income projections which in turn boosts liabilities requiring increased taxpayer contributions.

"A lot of people think we're just another state agency and we impact only the employees of the county governments and the state," Machida said. "But really, we impact everybody in the state of Hawaii through various ways."

Risk Equals Reward

The endless quest for greater investment returns has lured many public funds into alternative investments — those other than stocks, bonds and cash — where risks are greater, but so are potential rewards.

As of Dec. 31, the ERS had alternative investments worth at least $1.5 billion, with almost one-third in private equity and venture capital investments such as Trident Capital Fund VI that invests in information technology, wireless and other communications-related companies and the United States Power Fund that invests in power plants and other energy-generating projects.

The ERS Hawaiian Targeted Investment Program (HiTIP) — created in 2008 to comply with a state law mandating funding of local start-up technology companies — has committed $25 million to seven private equity funds that have invested in early stage Hawaii ventures. According to the ERS' annual report to the Legislature, since HiTIP's inception the private equity funds have directly invested $31.2 million in Hawaiian companies.

A subcommittee of the Employees' Retirement System and staff meet May 28, 2014, at City Financial Tower.

PF Bentley/Civil Beat

As of last November the ERS reported the seven funds had explored potential investments in 322 Hawaii-based companies and 78 were being tracked as candidates for possible future investment. Four companies in the HiTIP portfolio had initial public stock offerings — Versastem Inc. in 2012 and Conatus Pharmaceuticals Inc., Aranta Therapeutics and Receptos Inc. in 2013.

The governor believes Hawaii is on the right track but must remain vigilant if the state is ever going to make the system solvent.

"We are now on a positive trajectory and the fund itself is reaching all-time highs for investments," Gov. Neil Abercrombie said in a written statement. "However, the liabilities were very large, so we need to continue to find better ways of doing business."

What Do Hawaiians Invest Their Money And Time In

Source: https://www.civilbeat.org/2014/06/investments-art-gambling-public-money/

Posted by: kirkpatrickagescits.blogspot.com

0 Response to "What Do Hawaiians Invest Their Money And Time In"

Post a Comment